So in order to prime the pump you will take the cord and plug it in to a power bar you're going to unscrew the gray cap and fill it up with water always use your measuring cup anything below the max line water goes in on the top here you're going to turn your iron on at the back it takes two to three minutes to heat up and press your eyes when it's ready the indicator light shuts off and then in order to prime your pump you're going to turn the gray dial fully to the right then release all the steam pressure until it's fully drained you only have to do this priming method the very first time you use your iron.

PDF editing your way

Complete or edit your vita tce anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export tax preparation offices near me directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your tax preparation services near me as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your access irs account online by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

What you should know about Check IRS Payment Status

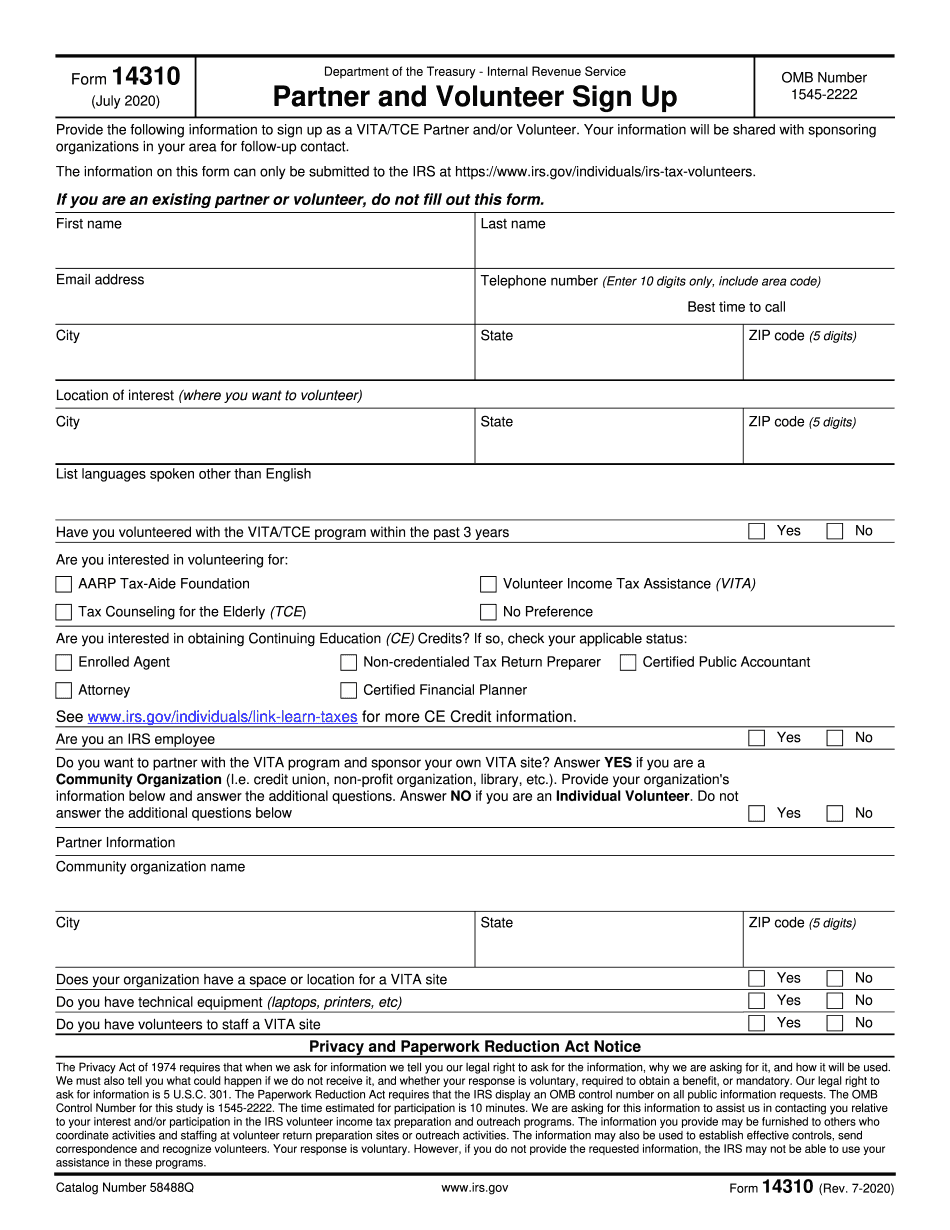

- Form14310 was last updated in July 2020.

- VITA/TCE programs offer free tax assistance to eligible individuals.

- IRS Payment Status can be checked online for convenience.

Award-winning PDF software

How to prepare Check IRS Payment Status

About Form 14310

I do not have access to specific information regarding the question about Form 14310. It is important to provide more context or relevant details to the question.

How to complete a Check IRS Payment Status

- Provide the following information to sign up as a VITA/TCE Partner and/or Volunteer

- Complete the required fields with accurate information

- Submit the form online for processing

People also ask about Check IRS Payment Status

What people say about us

The best way to fill in forms without mistakes

Video instructions and help with filling out and completing Check IRS Payment Status