Award-winning PDF software

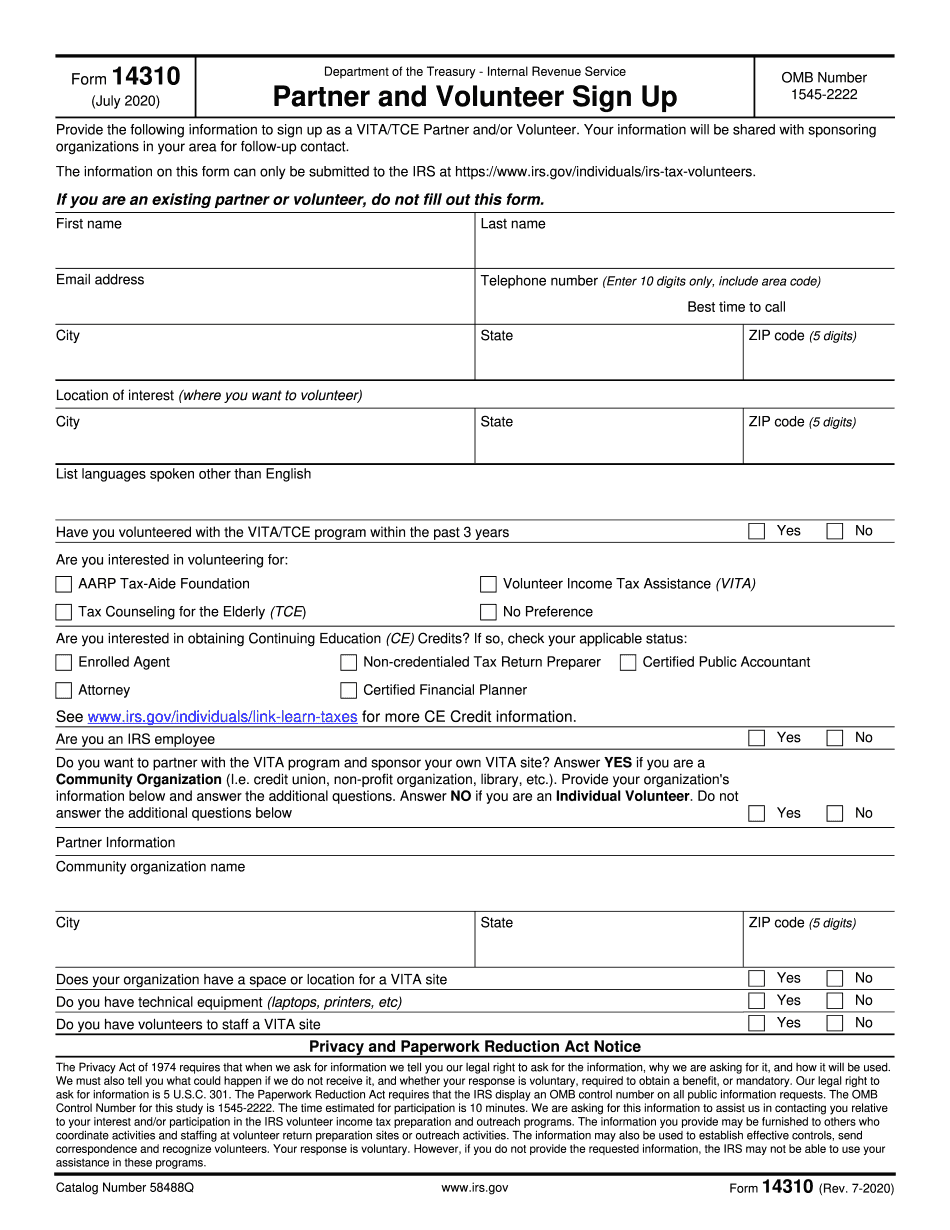

partner and volunteer sign up - internal revenue service

The following information can only be submitted by a direct deposit of Form 1099, reporting Form 1096. Form 1099-MISC must be mailed to the Social Security office at ________________________. If you are an employer and filed Form 1096, do not file this form if the amount shown is more than 1 million. If you are an employee, do not file this form if you receive more than 1,000 in wages. If you are a spouse, do not file this form if you receive more than 1,000 in wages. You may file Form 1099 with all or part of any remittance received. See instructions below. See instructions below for filing all Forms 1096 not specifically covered by Forms 4320 (payroll) or 4320A (wage reporting and payment procedures for a joint return) when applicable. The information on this form will be used to compute and will be reflected on your Federal Income Tax Return (Form 1040.

form 14310 "partner and volunteer sign up" - templateroller

This tax form can be used by taxpayers (including corporations, partnerships, and sole proprietors) with incomes of more than 100. It only applies when certain qualifying items are included in a taxpayer's gross income: (a) Dividends and interest from the taxpayer's investment in the partnership; (b) Royalties paid from the taxpayer's investment in the partnership; (c) Capital gains from the sale or exchange of stock in the partnership; (d) Gain from the disposition of property held by the partnership. If these items are not included in the taxpayer's gross income, the taxpayer is required to: (1) Disclose these items on Schedule F or Schedule S; (2) Provide copies of tax returns and tax-filing documentation related to those items; (3) Pay an additional 40% tax on such items. There is a penalty for missing any qualifying item. (See Notice 2010-41, 2010-36 963; and Notice 2010-61, 2010-43 799.) If the IRS finds a taxpayer is using this form for fraud purposes,.

14310 -fill and sign printable template online

Use IRS Tax Forms Online at the US Embassy. Online filing is a simple, secure, and easy way to get your taxes done right.

Tampa family psychiatry | personal psychiatrist for adolescent to

Florida Family Medicine Group, 5402-C Hwy 101 East, Bradenton, Florida 33412. Call Us. If you feel you have been personally affected by this tragic event please email us at, and we will be more than happy to put you in touch with someone who can guide you through any kind of counselling or support at your own expense. We have a team of psychologists who are trained to work with victims and their families. If you believe that your loved one suffers from Post Traumatic Stress Disorder, please do not hesitate to call, email, or visit with one of our team members. As a group, we believe there is nothing more important than keeping our children, teenagers, and young adults safe from harm. This includes not only family situations but also friends' kids and teens. By helping other parents, children, and teachers to be more vigilant on the outside.

Tax forms - clark & cassidy, inc.

If you are interested, please contact us at your convenience.